Earlier this week, the Obama administration and Congressional leaders from both sides of the aisle came to an overall federal budget framework covering the next 2 years (known as the “Bipartisan Budget Act” or BBA.) While in the end it still embodies an overall approach of austerity politics, it is MUCH less bad than many had feared, and also has some good provisions.

In sum, the on-again-off-again across-the-board budget sequester enacted as part of the Budget Control Act of 2011 (BCA) is temporarily suspended for the next 2 years, and new funding is provided to largely restore previous sequester cuts to slightly less than 2010 levels. These cuts have seriously adversely affected a variety of “discretionary domestic” social programs such as meals-on-wheels, Head Start, etc.

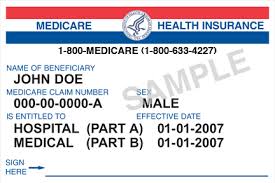

Social insurance programs such as Social Security, Medicare, and Medicaid, are largely held harmless except for:

- Modest changes to eligibility rules for Soc. Sec. disability (physician sign-off now required in all states.)

- Closing of some loopholes around Soc. Sec. survivor and spousal benefits that are often exploited by the wealthy beneficiaries.

- Continues current 2% provider cut under Medicare enacted under BCA.

There is also good news on the social program front:

- The impending funding crisis for the Soc. Sec. Disability Trust Fund has been put off for 7 years until 2022.

- The impending large Medicare Part B premium increase for certain Medicare beneficiaries has been suspended for 1 year, along with an large increase in the Part B deductible (given the fact that there will be no Soc. Sec. COLA in 2016.)

Other good news in the deal:

- The debt ceiling is raised “cleanly” (without any “pay-fors” or other policy riders.)

- New funding for the IRS for audits of hedge funds and the like, to yield some new revenue.

Left untouched by the deal – these will all have to be dealt with separately in the future:

- Reauthorization of the transportation trust fund.

- Renewal or sunsetting of certain “tax extenders” and tax breaks for various industries and special interests.

- Renewal of increases in the Earned Income Tax Credit and Child Tax Credit that were created under the American Recovery and Reinvestment Act of 2009 (ARRA, aka stimulus package.)

- Comprehensive tax reform, including (but not limited to) the taxing of U.S.-based corporate profits booked off-shore.

What’s next for Congress:

- Negotiating out and finalizing the appropriation bills necessary to keep the government funded. The current “continuing resolution” expires on Dec. 11. (N.B.: A government shut-down is still theoretically possible.)

- Parceling out the sequester restorations among various domestic programs (see above.)

- Dealing with one or more of the matters left untouched (see above.)

In sum, we want to thank everyone for all your advocacy efforts on these matters that you directed toward the Obama administration, Senators Schumer and Gillibrand, and members of the NY congressional delegation. Because of your work, the White House and Democrats stood strong, and even some Republicans joined in:

- against major entitlement changes and funding cuts

- against resumption of further sequester cuts (it has been suspended for FY 2014-15), and for restorations of previous sequester cuts (enacted in FY 2013-14.)

- for a clean increase in the debt ceiling

- for solving impending crises in Soc. Sec. disability and Medicare Part B

In the end, this deal is as much a political as a policy one, designed to get all parties past next year’s elections and over into 2017 when there will be a new President and Congress, who will then have to revisit these matters all over again, along with other important related issues. Elections will matter!

Finally, our work is far from done as there are still important outstanding matters yet to be addressed by Congress concerning tax fairness, economic recovery and prosperity, and military spending, any of which may or may not rise to the fore sooner or later. They, along with our core concerns over health care and social programs and austerity spending, are all of a whole. We may have a bit of breathing room now to turn from a largely defensive posture to go on the offensive to promote proactive ideas we want to see happen in these various issues areas that make up the whole. These ideas will help to frame the political debates for next year’s elections when we all hope that candidates who agree with and support our positions prevail. The future of the kind of nation and society we want to see realized hangs in the balance.

For a fuller analysis of this budget deal:

http://docs.house.gov/meetings/RU/RU00/CPRT-114-RU00-D001.pdf

Addendum (Oct. 29):

While this new agreement settled many things related to health care funding, other matters to repeal portions of the Affordable Care Act and discontinue funding for Planned Parenthood via a “budget reconciliation” process continues to move forward. The House passed such a bill last week, and the Senate is scheduled to take it up before Dec. 11, perhaps as soon as mid-November.