Now that the new Congress is settled in and humming along and the state budget process over, New York health care advocates are pivoting toward them and the Trump administration. As we look southward toward Washington DC, several categories of focus have emerged A good number of them carry over from the previous two years since the Trump administration came to power. However, the legislative landscape has now changed significantly with the shift of balance of power in the House of Representatives. These include:

- Rebutting the Trump administration’s ongoing moves to sabotage the Affordable Care Act (ACA), dramatically restricting access to Medicaid, and curtail family planning programs and reproductive rights.

- Opposing the Trump administration’s budget proposals for the 2020 fiscal year that begins on October 1st, particularly those provisions that affect health care and related human services, overall spending priorities, and EVEN MORE tax cuts ultra-rich.

- Improving the Affordable Care Act.

- Expanding coverage under Medicare and Medicaid in various ways.

- Curtailing prescription drug prices.

Digging down into the first two of these areas with more detail in Part I of this series, here’s what’s been coming out of the White House that cause us great concern:

Undermining the ACA – Since taking office, the Trump administration has undertaken a whole variety of efforts to undermine the ACA, including:

- Canceling “cost-sharing reduction reimbursements” to insurers for low-income policyholders who enroll in silver-level ACA health plans.

- Drastically slashing funding for advertising and public-private education/outreach programs during annual ACA open enrollment periods, and for enrollment assisters year-round in states that rely on the federal government’s online ACA marketplace system. Regional federal government staff were also banned from participating in any local outreach events.

- Canceling IRS enforcement of the “individual mandate” tax penalty for uninsured people who do not enroll in coverage but have no legal exemption. Eventually, the mandate amount was zeroed out in the Trump tax cut bill of 2017, thereby making it functionally non-existent while still technically on-the-books.

- Loosening the formulas used to calculate premium subsidies for people who buy ACA coverage so that they get less.

- Removing useful information for consumers about the ACA from government websites and social media platforms, and replacing it with propaganda of consumers discussing how the ACA has harmed them.

- Reducing the annual open enrollment period by 50% from 90 to 45 days, and shutting down the online federal marketplace website for “routine maintenance” on Sundays during this period.

- Allowing employers with “religious objections” to refuse to offer coverage of contraceptive care and termination of pregnancies.

- Allowing insurers to sell “junk coverage” through Association Health Plans and Short-Term Limited Benefit Plans, thereby negating the ACA’s requirements for 10 Essential Health Benefits and pre-existing medical condition protections. The short-term plans were also extended from 90 to 364 days.

- Refusing to defend the ACA against constitutional challenges brought by some states, and eventually openly siding with those states.

- Allowing states to lower standards for comprehensive benefits offered by insurers’ various health plans.

(See also: https://www.cbpp.org/sabotage-watch-tracking-efforts-to-undermine-the-aca)

Restricting Medicaid – Aside from continuing to try to repeal the expansion of Medicaid created under the ACA, the Trump administration is trying to impose by regulation a variety of ways to restrict eligibility to and use of Medicaid.

- The main way is to allow and outright encourage states to impose a whole lot of red tape and paperwork requirements that require Medicaid applicants and participants to continually prove that either they are a) working at least half-time, or b) qualify for work exemptions based on age, disability, informal caregiving responsibilities, or higher education.

- Methods to discourage enrollment include imposing premiums and co-payments, limiting available drug lists, ending preventive services for children, and non-emergency transportation to hospitals and doctors.

- Methods to restrict eligibility include lock-out periods for non-compliance with various requirements, ending presumptive eligibility for sick patients at hospitals, and imposing lifetime benefit caps.

- Allow states to only do a limited ACA expansion, unilaterally change eligibility criteria without federal approval, exclude abortion care providers, end 90-day retroactive coverage, and end transitional coverage when a family increases its income.

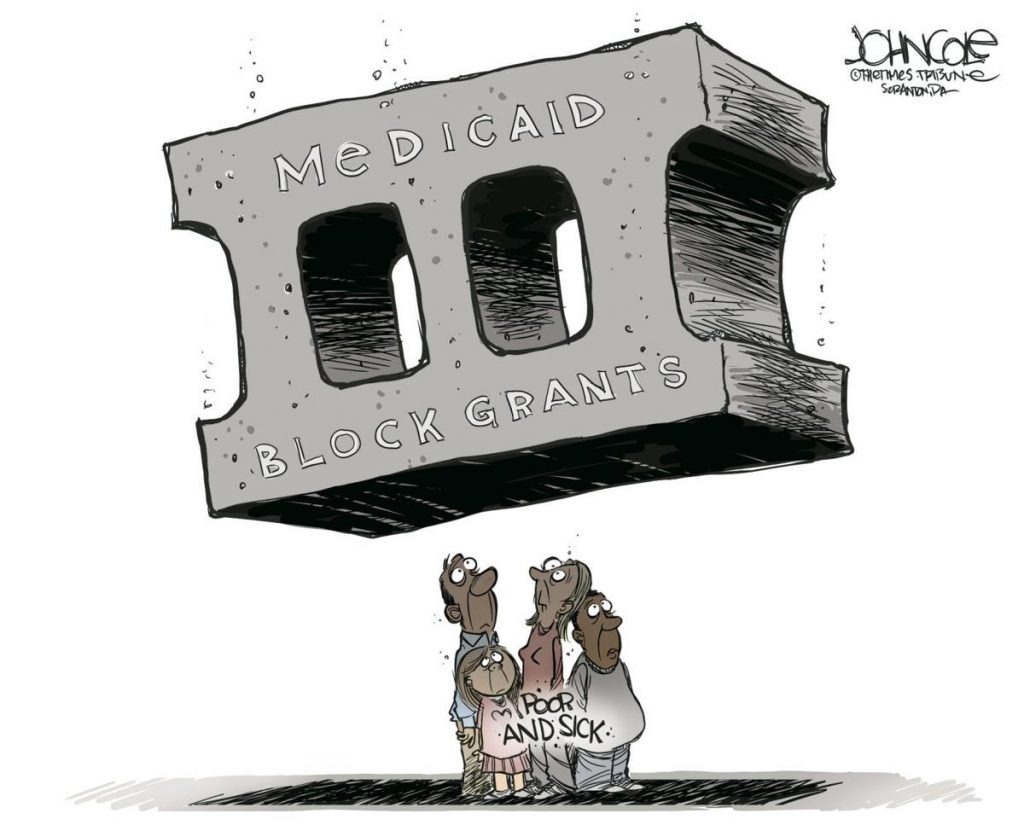

- Urge states to apply for special “block grant” waivers.

(See also: https://healthlaw.org/resource/sec-1115-waiver-tracking-chart-3-2/)

Many of these moves are being challenged in the federal courts as violating existing Medicaid law, and some rulings are putting them on hold. However, some of these changes are going ahead in the meantime, and people are losing access to Medicaid and some covered services.

Limiting Reproductive Health Care – Once it became clear that Congress was not going to do so in law, the Trump administration is now moving by regulation to end “Title X” and Medicaid family planning funding to any health care entities that provide abortion counseling, referrals, or care. This move will primarily effect Planned Parenthood facilities. Once a final rule is published, there will likely be lawsuits challenging the new policy as illegal. These steps are in addition to moves to allow employers to deny insurance coverage of contraception if they so choose, based on the religious beliefs of the business’ owners. Further, the administration is allowing any health care provider to refuse to provide reproductive health care services based on religious beliefs, and even to refuse to treat certain patients whatever their health care needs.

Trump budget proposals – As in previous years, looking at the health care provisions as a whole, they embody the general approach of the infamous “Graham-Cassidy” proposal rejected by the Senate two years ago, yet it goes farther. The “big idea” is to lump all health care and human service funding coming into states (Medicaid, Children’s Health Insurance Program, the ACA, food assistance programs, housing subsidies, income assistance, other “categorical” programs, etc.) into ONE gigantic block grant while simultaneously drastically cutting the total dollar amount of such funding, and dramatically scaling back federal requirements and oversight, all in order to “let states innovate”. Many fear that what will actually result is a real-world “Hunger Games” wherein states would be saddled to pick up the slack which they could not possible do or manage. The results would be quite drastic, particularly in states like New York where we have a long history of robust health care and social programs to support struggling individuals and families.

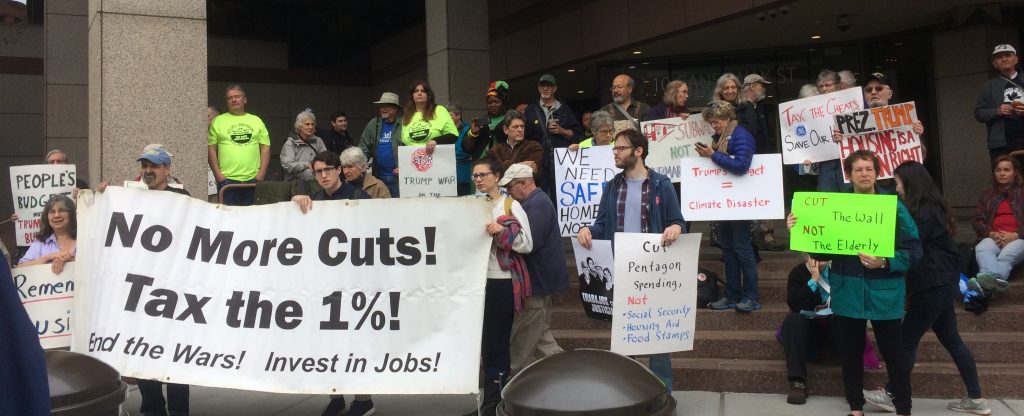

Simultaneously, the Trump administration proposes to reorient spending increases away from the full range of non-defense discretionary spending that funds many health and human service programs, and increase spending on defense and national security. This change would break a decades-long bipartisan agreement that whatever overall spending increases or decreases happen on one side of the budget (e.g. defense) is comparable to what happens on the other side of the budget (e.g., domestic.)

In addition, the administration proposes to permanently extend the personal income tax cuts included in the Tax Cut and Jobs Act of 2017 (aka “Trump tax cut bill”), most of which benefited the ultra-wealthy. That bill included tax cuts for large corporations and special interests which already are permanent, but the personal tax cuts were only put in place for 10 years (through 2026.) Taken together, those cuts blew a whopping $2 trillion hole in the federal budget deficit over the next decade. Making the personal tax cuts permanent will add another $3 billion to the deficit, leading to a total deficit increase of nearly $5 trillion. The ONLY way to pay down a deficit of that big a size without raising any taxes of any sort will be to drastically slash spending on major social entitlement programs such as Social Security, Medicare, Medicaid, and SNAP/Food Stamps, as well as the whole range of health, human service, education, and economic development programs.

Advocates’ responses — All 12 Congressmembers from New York City belong to the new House Majority which, as a whole, is publicly opposing all these moves by the Trump administration. Nonetheless, advocates have been meeting with them to voice our concerns, and support their efforts to lead our nation in a different direction. In particular, we have been seeking to engage with the two new members of our city’s delegation (Rep. Max Rose whose district encompasses all of Staten Island and parts of southern Brooklyn, and Rep. Alexandria Ocasio-Cortez whose district encompasses parts of southeastern Bronx and western Queens), as well as Rep. Hakeem Jeffries who is now the fourth-highest member of the House Majority leadership. Other congressmembers from New York of importance are those who serve on the relevant committees of jurisdiction (Ways and Means, Energy and Commerce, Education and Labor, Budget, Appropriations.) In addition, New York’s senior US Senator, Charles Schumer, is the Minority Leader of the Senate, and our junior Senator, Kirsten Gillibrand, is a candidate for President, so there are lots of opportunities for us to take advantage of, and lots of bases to cover.

In addition to engaging with lawmakers directly, we are also reaching out to everyday New Yorkers to help them understand what’s at stake for them, their families, and our communities, and what they can and should do. The statewide “Renew the American Promise” (RAP) campaign was established at the beginning of this decade to bring forces together from across New York State in a coordinated effort to defend the broad range of health care and human service programs, and support budget and tax policies that keep them strong. Simultaneously, RAP is promoting policies to improve and expand these programs to help more New Yorkers in need. (More on all that in Part II of this series.) Metro New York Health Care for All helps to anchor RAP along with Citizen Action of New York, New York State Alliance of Retired Americans, and New York Statewide Senior Action Council. The campaign fosters and guides loose coalitions of groups in strategic regions and congressional districts across the state to take action.